The coronavirus is serious and deadly. It could escalate into to a major pandemic and have a dramatic impact on our economy and therefore stock prices. Then again, it might not. This is when we remind ourselves of the principles that have worked for us over and over again, through the ups and downs of the markets.

Our Guiding Investment Principles:

- We are not gods and cannot predict the future.

- Organize your investments so you can live off your cash flow: The Goose that Laid the Golden Eggs.

- Invest for the long-term, don’t speculate: The Tortoise and the Hare.

- Be prepared for the flood. In other words, there will be events personally and globally that will be very scary and dangerous. Prepare for them.

It will be perfectly clear in hindsight what we should have done. However, no one can predict what events will unfold before they happen. No one.

After 30 years of experiencing the ups and downs of the markets, we have a process for situations like this: the floods of life.

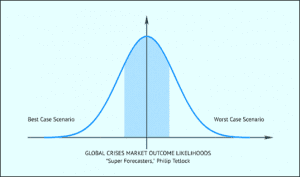

It is derived from the work of Philip E. Tetlock, author of “Superforecasting.” The bell curve shown here represents the distribution of possible results. The left side of the bell curve represents harmful, economically challenging and deadly outcomes. The right side of the bell curve represents headaches and hassles but no long-term effects. You turn on the news and you’ll hear pundits predicting across the spectrum. The reality is that no one knows.

It is dangerous to make predictions. People who make predictions must defend their positions and often ignore contradictory data as it becomes known. This leads to errors that can destroy wealth. At FourThought we will not make the mistake of predicting.

We use an approach that we call “street signs.”

Imagine you are in a city and are told that you are going to go on a two-hour car ride. You don’t know the driver’s intended destination and you have no control over the ride. You must determine where you are going on your own. You may have some clues early on, but as you leave your driveway you still have no idea where you are going. As you ride however, signs begin to appear. If you leave Atlanta and see a sign that says, “Charleston 300 miles,” you can deduce that your final destination isn’t Texas.

In the same way, we don’t predict; we forecast. We acknowledge what we don’t know, then use the data that is available to us and make adjustments as signs becomes clearer.

The first step in this process is to determine the full set of possible outcomes.

In our view, the low-probability, best and worse-case scenarios are not as extreme as they have been with some other “floods” in the past. The best case is that we control the spread of the virus, morbidity rates are low and a treatment or vaccine becomes available quickly. The outcome might be similar to that of a really bad flu season.

The worst case is that the virus spreads uncontrollably, we don’t develop effective treatments and morbidity rates are similar to those in the Hubei province of China, the epicenter of the virus. We could expect some communities to be economically shut down for months at a time. We can’t predict the economic impact, but we can imagine that it would be similar to that of 9/11, when the country basically shut down for a month. The reality will most likely be between somewhere between the extremes.

The first street sign indicating that action was necessary was when the Chinese failed to contain the coronavirus, and infection and mortality rates shot up in the Hubei province. Seeing this, we at FourThought raised some cash, postponed investment for some clients and took some profits in companies that we felt were particularly exposed. We trimmed positions in Apple and Nike and invested in cash and 3M, the largest manufacturer of protective masks.

Now we are looking at three street signs that will give us clarity on the appropriate next steps:

- Rates of infection spread/containment

- Mortality/survival rates

- Therapies and vaccines

Infection/Containment Rates

The coronavirus has proven to be very infectious. As of this morning, March 3, we have 100 cases in the U.S. There are many stories circulating, especially on social media. We are being careful and diligent about the source of our data, using only respected sources with real science behind them. We don’t want to be victims of the spin of fear mongers or politicians. The New England Journal of Medicine is one great source we are utilizing.

Mortality/Survival

Was the high death rate in China the result of some peculiar aspect of the virus, or the patients themselves? Our sources indicate that the majority of mortalities in China have been older in older men who smoke. Of course, the impact is in other population segments remains to be seen.

Therapies and Vaccines

Will we be able to ramp up production of respiratory equipment? Will the companies focused on finding a treatment, vaccine or cure be successful? Will the virus incubate over the summer and allow us time to ramp up? These are questions that will soon be answered.

The next two weeks will tell us a lot. As the data becomes clearer, we will act appropriately. Our playbook will vary based on these street signs. Our actions could include extremes like additional selling of stocks and buying gold to opportunistic buying of companies that are oversold and have strong long-term prospects.

It is important to remember that this is not the end of western civilization.

We have been investors through multiple crises. We have learned to follow our principles and look at “street signs” because the process forces us to analyze the facts as they develop, without biases and reactive emotions.

We appreciate your confidence and are always available for questions.

DOWNLOAD A PDF OF THIS WHITE PAPER BY COPYING THIS LINK AND PASTING INTO YOUR BROWSER: https://fourthought.com/wp-content/uploads/2020/03/FourThought-Private-Wealth-Coronavirus-Investing-FIN.pdf