Great children’s stories often teach lessons about our world that can help their readers for a lifetime. The basic truths they teach often apply to investing.

In Hans Christian Andersen’s “The Emperor has No Clothes,” a vain king is tricked into believing he is dressed in “invisible” finery when he is actually undressed, but no one is willing to point out the obvious because they fear appearing stupid and unworthy. The emperor goes on a parade and all his subjects react positively to the new outfit except for one little boy who blurts out that he is wearing nothing. The moral of this story is that we can’t let pride keep us from speaking up when we see something that contradicts what we know to be true.

Modern Portfolio Theory: An Old Gold Standard

Modern Portfolio Theory (MPT) is investment orthodoxy. It posits that an investor should construct a portfolio that is diversified across asset classes with various correlations to reduce risk. Think about pistons in a motor. If different pistons fire at different times, the engine runs smoothly and provides constant power.

At FourThought we don’t have problem with MPT—as long as you don’t need income. But as we know many people do. In fact, that is why they work so hard to save money–so they can have income when they retire.

Two Significant Risks

When investors intend to take withdrawals for income, there are two major risks: sequencing risk and reverse dollar-cost averaging. That is why, like the little boy declaring that the king was naked, we challenge the validity of MPT for investors who make withdrawals from their portfolios.

Sequencing risk is the danger that a portfolio’s long-term average return can mask the risk of short-term underperformance. Our “Tale of Two Sisters” post (read here) is a parable that demonstrates how two sisters with the exact same investments, retiring at the same age and making the same withdrawals, can grow rich or go bankrupt: depending on their starting investment date.

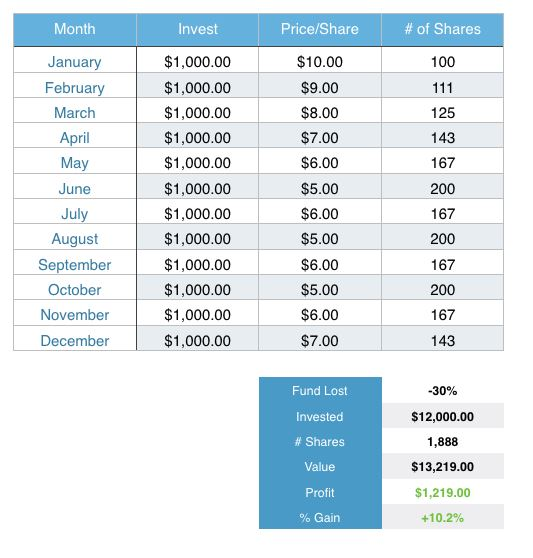

Dollar cost averaging example

The second risk relates to dollar cost averaging. It is a time-tested strategy for buying variable assets, gradually and over time, at below-average costs by investing the same amount in a stock every month. It tends to be more effective in volatile or down markets. The chart is an example of how it works.

If dollar cost averaging works as a strategy to systematically buy more when prices are volatile, the reverse must be true.

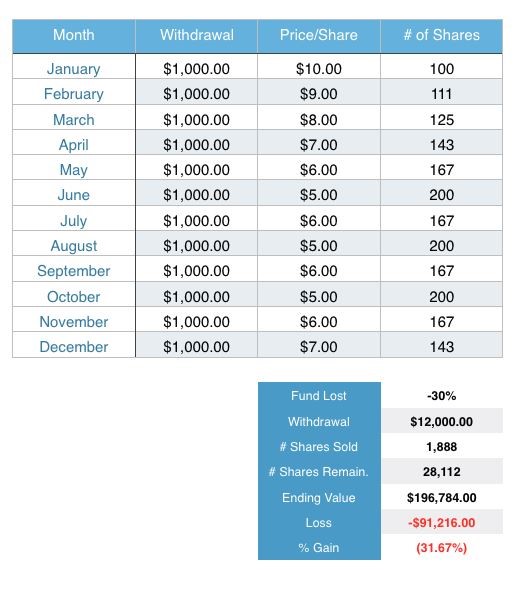

When you start to take distributions from a portfolio, if you regularly sell your assets at a fixed dollar amount you will inevitably sell more when the asset is down than when it is up, as shown in the chart below. This strategy ensures you will always receive an average selling price that is below the average—violating the “always sell high” principle of investing.

The process of rebalancing a portfolio can mitigate this risk somewhat by forcing an investor to sell a better performing asset and rebalance into a poorer performing asset or asset classes.

However, when the need for steady income has a fixed time horizon (as is the case with many retirement investors), systematic withdraw plans can be devastating.

Reverse dollar cost averaging example

The MPT strategy says you shouldn’t worry about how the return is generated as long as the total return (dividends plus appreciation) is higher, on average, than your income need. Reverse dollar cost averaging shows us how that theory can fall apart.

The Third Sister

While the first two sisters showed us sequencing risk, there is a Third Sister, an entrepreneur, who built a solid small business that she plans to turn over to her key employees. Her company is worth $1 million and it generates solid profits.

After paying all her expenses she makes as much as $120,000 and as little as $60,000 a year for herself. On average the company has made around 9% per year in net profit. Her plan is to take a maximum of $60,000 out per year to live on. She gathers her attorney and key employees to decide on the future dividend/distribution policy for the company. They come up with two options: the first is they call the “growth” option and the second the “growth and income” option.

The Growth Option

In this scenario earnings are retained to grow the company. The business is growing steadily, and the management would like to invest earnings in opportunities for the company. Because the Third Sister needs income on which to live, her advisor recommends that she can sell some of her shares in the company to generate her required cash. They argue that if the company grows at 9% per year and you are only selling 6% of your holdings, even though your percentage of ownership is going down, the value of your holdings are going up.

The Growth and Income Option

Because the management of the company is confident that they will always make at least $60,000, they suggest just paying the third sister the $60,000 she requires as income. In the good years they will have excess profits to reinvest into the business. The business can establish a dividend policy whereby the owners take some of the earnings and the company retains some of the earnings. The Third Sister would be able to live off these dividends and not sell any of her stock.

The problem with the growth option occurs when there is a recession. Peoples’ willingness to buy shares in a company is based on calculable earnings and assets. Unfortunately, there is also emotion involved. When people are optimistic they maybe willing to pay 18 times earnings; when they are pessimistic they may only be willing to pay 13 times earnings.

The effect of selling shares of a company to generate income is that you inevitably sell more of your ownership when the price is low versus when the price is high.

It is a dangerous double whammy for the Third Sister because profits are lower in a recession and investors are pessimistic. She would end up being forced to sell and accept a lower than average price.

Investors are faced with a “Third Sister” conundrum when determining what type of stock to buy.

Some of the fastest growing companies have never paid a dividend—like Amazon and Biogen.

These are wonderful companies and may be great total return investments. Other companies with similar growth characteristics choose to pay a dividend, like Apple and Amgen.

It is important to think about what type of security will meet your needs and the companies in which you are investing. If you don’t need income and are in a high tax bracket, consider investing in companies that don’t pay dividends. If you need income, however, invest in companies that pay and grow their dividends.