I had a good friend who lived to be 95 years old. Over the course of his final year, he constantly talked about his and his late wife’s 75th wedding anniversary approaching at the end of spring. He wanted to celebrate their life together one more time. Late one April night, I was visiting him in the hospital when he asked the doctor for the date. The doctor responded, “The 15th.” My friend said, “Ah, shoot,” and passed peacefully knowing he would not have to file his taxes.

The human aversion to paying taxes is universal. We know it’s unavoidable if we have income, but we never, ever want to pay more than absolutely necessary.

The human aversion to paying taxes is universal. We know it’s unavoidable if we have income, but we never, ever want to pay more than absolutely necessary.

An Opportunity Amid Chaos?

While the coronavirus crisis is crushing the markets and economy, one of the opportunities it may present for some savers and investors is the chance to convert a traditional IRA to a Roth IRA.

Under the right circumstances, converting to a Roth IRA can help reduce your taxes and provide financial flexibility just when you need it most—in retirement. Two significant benefits of a Roth IRA are tax-free distributions and no required minimum distributions (RMDs) when you reach 72. This gives the retired you more control over how and when you spend your money.

In addition, unlike a traditional IRA, money in a Roth IRA can stay there and continue to grow tax-free for an extended period.

How Do You Know if You Can or Should Convert to a Roth?

First, it’s important to establish that taxes on money in Roth IRAs are paid up front, so when you take money out of the account your tax responsibilities are behind you. However, taxes on traditional IRAs are paid when the money is taken out. They are considered tax-deferred. The question you must ask yourself is, “In which scenario would I likely pay more?”

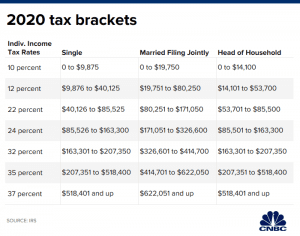

If you have reason to believe your tax bracket now may be lower than the one you will find yourself in when you’re retired, a Roth conversion may be advantageous. But how can you know what the tax brackets will be in the future? You can’t. However, you can take a couple of factors into consideration:

- Current tax rates

- A reasonable assumption about future tax rates

- Your taxable income in the current year

- Your life expectancy

- Your current future cash flow needs

- Legacy goals

- The current market environment

Okay, that’s more than a couple. This is where your planners can help.

You may find that a Roth conversion analysis is a simple mathematical equation.

If you save more by converting and paying your taxes now, that may be all you need to make your decision.

However, it’s rarely that simple. The following scenario demonstrates this point.

In order to be eligible for tax-free distributions from a Roth IRA, you must have had a Roth IRA open for at least five years and be over 59-½. This five-year clock starts on January 1 of the year of the conversion.

If you have never owned a Roth IRA and complete a Roth conversion in November of 2020, the five-year clock would start on January 1, 2020 and you could take tax-free distributions starting January 1, 2025 as long as you are at least 59-½ by then. But if you have been depending on your traditional IRA for retirement income, a conversion may not make sense because it would tie up your source of income for five years. Alternatively, a partial conversion may still be suitable.

While a Roth IRA conversion certainly isn’t for everyone, our team of planners believes the current situation presents a favorable environment for it.

Why? Current tax rates are historically low. A retired couple filing jointly could convert up to $326,600, given no additional income, and be placed in the 24% tax bracket.

Another historical rate on 2020’s list is our government’s spending. Taking the United States’ rising debt into account, many believe tax rates will increase in the future. Someone has to pay on the debt, right?

Additionally, retirement account values have fallen during the coronavirus crisis. Imagine that pre-virus, the holdings in your traditional IRA were valued at $100,000 and a Roth conversion is completed, showing distributions of $100,000 on your 1099-R at the end of the year. You would pay income tax on that amount. However, when the global pandemic devalues your account to $85,000 and you convert, you pay taxes on $85,000.

If a vaccine or cure is discovered in the following months or years and your account value returns to full strength, you come out of the crisis with not only a deeper appreciation for childcare professionals, but less money out of pocket due to your tax savings.

Required Minimum Distributions are Waived

Additionally, this year’s crisis has presented an unexpected opportunity for retirees who typically take required minimum distributions. RMDs have been waived for 2020 as one of the components of the recently passed CARES Act. If you are over 72 and do not have other sources of taxable income, a Roth conversion may be able to add value in 2020.

For this reason, our team is currently completing a cost-benefit analysis for all clients who have required minimum distributions.

Are You a Roth IRA Conversion Candidate?

While every case is different, many investors are currently experiencing portfolio losses. Combine that with relatively low federal taxes, the possibility of higher future taxes and a favorable regulatory environment. This creates the right set of circumstances for a Roth conversion. If you are considering a Roth conversion, please contact us or your current financial advisor.