Don’t look down.

My favorite hobby is mountain biking. I love getting on a trail with my favorite podcast or audio book and lose myself in the woods. This past weekend I was peddling in the Carlton Reserve when I came to a man-made, dam-like structure. There is an alligator who hangs out near there and you never really know exactly where she is. Sometimes as you go over the bridge you’ll startle her and she’ll react and go under, but most of the time she isn’t there.

The key to getting over the dam safely is to keep your vision forward—to look where you intend to go and avoid focusing on your tires. When you look down you lose your balance and are pulled in a direction you definitely don’t want to go.

Today, it is critical to keep your eyes on what is on the other side of the riverbank. We are looking at 2021-22. It feels like it’s a long way away, but how many of us wonder where the past year went? Time moves quickly. That is why we keep reminding our clients to stay focused on next year and not the noise of today’s 24-hour news cycles. Covid 19 is a virus. We believe that, by 2021 the worst of it will be behind us.

We also believe that there is a high probability that the stock market recovery will be swift and will catch people by surprise. Our advice is to get invested and hold tight.

There are three reasons we think the recovery will be swift: history, the nature of pandemics and our economy.

History

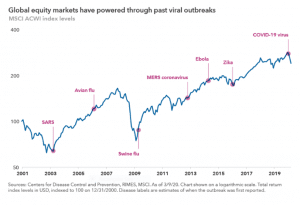

Previous epidemics have caused swift market declines followed by equally swift market recoveries. I know, there are a thousand reasons why this one is different—but mainly because of its rapid spread and impact. The point is that previous health related threats have caused swift declines followed by swift recoveries.

The Nature of Pandemics

In the last 20 years we have experienced two substantial, 30-percent or greater declines in the market: the tech bubble/9/11 and the global financial crisis of 2007-2008. Both of these were events that many said, “had never seen before,” and required unique and untested government responses. The tech bubble was caused by irrational pricing of technology stocks and was exacerbated by terrorism and corporate malfeasance. The global financial crisis was caused by malfeasance of lenders, investment bankers, borrowers and rating agencies. These caused significant losses that took time to repair.

The current crisis is a virus that will evolve from both an epidemiological and economic perspective. It was caused by an exogenous event—not an excessive pricing bubble or fundamental economic problem.

We can look at Asian countries including China, Japan and Taiwan for a glimpse of how the crisis started, how it will evolve and what the future holds. The virus started in China in December. By February, the Chinese Government reacted. Now, at the end of March, the infection rate is growing smaller and China is getting back to work.

Our Economy

In February 2020 we had what was arguably one of the strongest economies in American in history. We had high employment, low inflation, rising wages, low personal debt and high consumer balance sheets. But now, this virus has taken our entire country offline. It is hurting small businesses like nothing we have ever experienced.

We must remind ourselves that the reason we are practicing social distancing and effectively shutting down our economy is to save lives. We are doing it to give our health care system time to prepare and manage, so it can help us get to the other side as soon as possible. Once this happens, as we always do when faced with an economic crisis or natural disaster, we will look at each other and say, “lets get back to work.”

Obviously, we are not gods and can’t predict the future. Anything can happen, and another flood can come; is entirely possible that Russian and Saudi Arabia trigger a war. We must be prepared for things to get worse. But, keep your eyes on the riverbank and not your tires. Give yourself the proper perspective, keep your balance, and focus on the destination.