One of the four key principals of our investment strategy at FourThought Private Wealth is summarized in the statement, “Don’t eat the goose!” This is an obvious reference to Aesop’s “The Goose that Laid the Golden Egg.”

This 1500-year-old fable is so ingrained in our social fabric that when we hear it we instantly understand its meaning and agree with it. This is a moral we seem to have always known. The fable teaches us the perils of greed and living beyond one’s means. There is also something about it that makes us thankful for what we have.

The Goose as a Metaphor for Dividend-Paying Portfolios

For our clients, the “goose” is a diversified portfolio of carefully selected companies that pay a good dividend (the golden eggs) to shareholders. What’s more, they steadily increase the amount of their dividends so shareholders can use the proceeds to enjoy their preferred quality of life.

How do We Protect the Goose?

At FourThought Private Wealth, our investment committee specifically looks for companies paying dividends that are secure and growing. We have developed a process for doing that, which has shown success.

The golden eggs are dependent on the health of the goose. Likewise, the dividend payments are dependent on the health of the companies that generate them. This leads to the question:

In a pandemic, can we quarantine the goose?

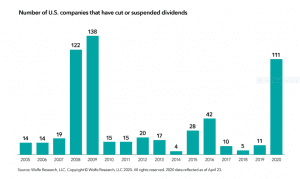

Covid-19 has decimated the revenues of thousands of companies. Some great companies like Boeing and Disney have cut or eliminated their dividends to preserve cash so they can survive. The charge below shows the number of U.S. companies that have cut their dividends this year, up over 1000% from 2019.

Political and Social Pressures are Playing a Role

In addition to cash drain, there is now a political and social calculus that must be considered. There is concern among some that if a company receives help from the government, it shouldn’t simply turn around and send money to shareholders. This makes sense. If a business is in such dire straights that it needs a government bailout, it should not make a distribution to owners.

In Europe, the European Central Bank has applied more pressure than in the U.S., and many companies are strongly encouraged not to pay dividends.

Some Companies Are Still Paying Dividends. How Do We Find Them and Protect the Goose?

This week we interview two of FourThought Private Wealth’s investment committee members to ask them about FourThought’s processes for finding those rare geese that still pay dividends and help smooth out income volatility.