Download Our Latest Whitepaper HERE

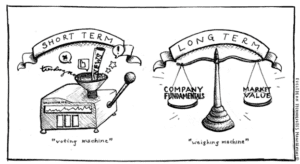

Benjamin Graham, the ‘father’ of value investing and teacher to Warren Buffett once stated that “in the short run, the market is a voting machine but in the long run, it is a weighing machine.” Graham’s comments are prescient. We can’t underestimate the impact of emotions on investment decisions. In this paper, we will share some of the tools we use to keep our focus on the “value machine” for our clients to build long term wealth.

Core Beliefs

One of our core beliefs as a firm is: “We are not Gods.” We do not have a crystal ball that tells us what stocks will do over short periods of time. However, we do believe over long investment horizons, buying high-quality businesses that have certain qualities such as healthy balance sheets, a repeatable sales process, and defendable competitive advantages, will lead to attractive returns.

The voting vs valuing machine metaphor is particularly applicable today. It implies that the market can behave like an (often irrational) electoral contest in the short term, determining a company’s share price based on how popular or unpopular it appears at that moment. When markets behave like a voting machine, they tend to ignore a business’ underlying fundamentals and are driven by news headlines, speculation, sentiment, and other noise.

When the ‘noise’ is ebullient, short-term voting will be overwhelmed by optimism and propel a company’s shares beyond a reasonable value.

When the ‘noise’ is ebullient, short-term voting will be overwhelmed by optimism and propel a company’s shares beyond a reasonable value.

We saw this behavior during the market rally of 2020-2021, when virtually all assets experienced a surge in price. During this risk-on environment, many companies reached all-time highs, regardless of long-term fundamentals like growth prospects and balance sheet quality.

In contrast, during a volatile risk-off environment like we have seen this year, fear can take over and move the short-term voting machine in the opposite direction. When this is the case, it’s common to see market participants throw the “baby out with the bathwater”, selling everything (both of low and high quality).

Timeless Proverbs

Remember the 1700-year-old parable written by Aesop: The Tortoise and the Hare. We know that “slow and steady” wins the race and growth is not linear. Those who run for the exit and sell their high-quality long-term growth businesses at deep discounts soon regret it. Experience has taught us to ignore the emotion and focus on the value.

The path to compounding is not without obstacles and nothing goes upward forever. The key is, resist being alarmed by the noise of the voting machine (and sell), and instead focus on the valuing machine. One example of this is Meta Platforms (formerly Facebook). Since the company IPO’d in 2012, Meta has been a great investment – the stock is up over 400% (17.89% annualized). In order to experience those returns, investors would have had to endure five declines of 30% or more and another one now of more than 50%!

The bottom line is to focus on the news of the company’s long term business performance and not the noise of the day.

The FourThought Way

Here at FourThought, our research team has a process for analyzing companies. We combine Quantitative Analysis, Fundamental Analysis, and Institutional Fundamental Research through our relationships with top-class asset managers.

Quantitative Analysis

Our Quantitative analysis compares a business’s statistics (i.e., P/E ratio, revenue growth, etc.), to the industry the company resides. We produce the “FourThought Quant Score” based on how the company ranks versus their peers. Quant scores function as a gatekeeper, only allowing stocks to pass through if they meet our baseline investment criteria.

Quant analysis also provides an efficient way to quickly screen thousands of companies in a matter of minutes. This improves research focus and investment process productivity, as we can immediately eliminate a whole host of stocks that lack desirable scores.

Quant analysis also provides an efficient way to quickly screen thousands of companies in a matter of minutes. This improves research focus and investment process productivity, as we can immediately eliminate a whole host of stocks that lack desirable scores.

Think of the quant analysis as a large funnel, whereby numerous companies go into the screen and only a few desirable companies make it out.

Fundamental Research

- Durable Competitive Advantages (Aka Moat)

Competitive advantages can come in all shapes and sizes, but at a high level, we are looking at characteristics of a business or industry that would make it difficult for competing companies to take market share away from the company.

Some of the competitive advantages we look for include: the structure of the industry (fragmented or consolidated), barriers to entry, pricing power on suppliers/consumers, etc. Other competitive advantages can come from intangible assets such as brand loyalty, patents, and network effects.

- Repeatable Sales Process

It is more expensive for a business to attract new customers than to retain existing customers. Thus, we gravitate towards businesses that have a repeatable sales process and a ‘sticky’ customer base. The repeatable sales process is easily conceptualized with Software as a Service (Saas) companies, who typically have a subscription model – think of Apple and their Apple Music subscription. Once you subscribe to the service it will take a lot to move you. This idea does not just rest in the Information Technology sector, similar pricing models exist virtually everywhere.

- Consistent Free Cash Flow Growth

We calculate the actual cash generated from normal business operations, after capital expenditures and payments to debtholders are satisfied. In other words, this is the true cash the business uses for certain things such as: pay dividends to shareholders, buy back shares, extinguish debt outstanding, or reinvest back into the business (think R&D).

Not only are share buybacks and dividends attractive to investors, but the reinvestment activities are extremely important for emerging growth companies. This allows them to expand their competitive advantages while limiting competition and expanding the market.

- Strong Management Team

We look for innovative leaders with the experience and ability to execute. The management team needs to match the maturity of the company. There are builders and there are managers. Steve Jobs built Apple; Tim Cook manages Apple.

Culture is critical for high-quality companies. Companies with strong cultures have more productive teams, attract and retain talent, and are superior at value creation.

- Efficient Return to Shareholders

We call this ‘Capital Stewardship’ – or management’s ability to generate a high return on invested capital (ROIC). These companies embody a disciplined expansion around their core brand. They do not seek to fund growth solely through mergers and acquisitions and take opportunities to reinvest while keeping their competitive advantages.

Dividend policy and capital structure as a whole are important. Companies with ample liquidity and a quality balance sheet can be nimbler and pursue investment opportunities, without having to access the capital markets as frequently.

Growth At a Reasonable Price (GARP)

We develop an ‘intrinsic value’ for every business we invest in. This involves a Discounted Cash Flow (DCF) model, where we use financial data, sell-side research, and our contacts at other asset managers to gather data on the company and underlying business. From there, we assign a growth rate (or multiple growth rates depending on the business), forecast cashflows in the future, and discount them back to today at some rate of return.

This value is the intrinsic value or what that series of cash flows should be worth, given the current market environment. This value may differ from the current share price of the company which becomes very interesting to us. We want to buy when a company is trading below its intrinsic value (with a margin of safety) and sell when the current price is well above the “intrinsic value.”

In this paper, we introduced the concept of the market as a voting machine, where short term emotions dictate stock prices and a valuing machine where underlying business performance drives long term results. We also shared some details on our “valuing machine” process. We hope you found this information on our FourThought process models valuable and informative and we encourage you to contact us any time to learn more.

FROM THE DESK OF

JAKE MACFARLANE

Research Analyst

SCOTT PINKERTON, CFP®, CIMA®, CPWA®

Partner, Planner

Important Disclosures